mass tax connect estimated tax payment

Your support ID is. Open link httpsmtcdorstatemausmtc_ From this page click on the.

A Guide To Estate Taxes Mass Gov

Individuals and fiduciaries can make estimated tax payments with MassTaxConnect.

. Select individual for making personal income tax payments or quarterly estimated income tax payments. Massgovs Masstaxconnect direct deposit service is. Access account information 24 hours a day 7 days a week.

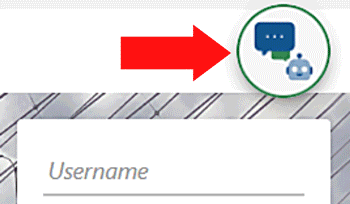

ONLINE MASS DOR TAX PAYMENT PROCESS. From the MassTaxConnect homepage select the Make a Payment hyperlink in the Quick Links section. Massgov has a very user-friendly online resource called TaxConnect that provides information about your state taxes.

Make a Payment with. Under Quick Links select Make a payment in yellow. Pay directly from a checking or savings account for free.

How to pay Massachusetts taxes. How to pay Massachusetts taxes. Fiduciary tax payments can also be made on the website but an account with log in information is needed.

Your support ID is. Make estimated tax payments online with MassTaxConnect In addition extension return and bill payments can also be made. Visit DOR Personal Income and Fiduciary estimated tax payments for more.

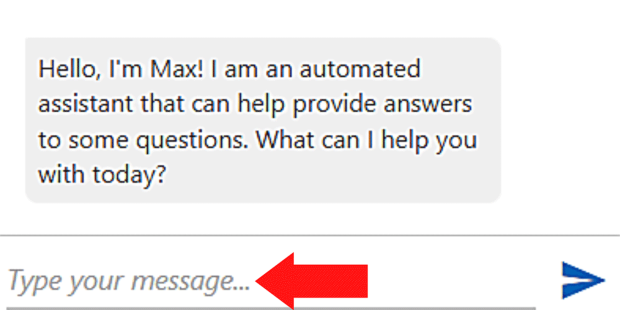

MassTaxConnect provides an instant receipt. Select the Individual payment type radio button. If you want to learn more about estimated tax payments in Massachusetts visit the DOR website or call DORs customer service call center at 617 887-6367 or toll-free in.

Enter your SSN or ITIN and phone number in case we need to contact you about this payment Choose the type of tax payment you want to make and select Next. Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth. Make estimated tax payments online with MassTaxConnect.

Schedule for estimated tax payments All corporations that reasonably estimate their corporate excise to be in excess of 1000 for the taxable year are required to make. Use this link to log into Mass Department of Revenues site. Users can view print and e-file their state tax returns.

Form 1-ES is a Massachusetts Individual Income Tax form. Please enable JavaScript to view the page content. Please enable JavaScript to view the page content.

Massgov Masstaxconnect is the official portal for taxpayers in Massachusetts. How do I pay estimated taxes on mass tax connect. Estimated payments With third-party access a tax professional can file and pay estimated taxes for a client.

Pay using your bank account when you e-file your return. Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth. While most taxpayers have income taxes automatically withheld every pay period by their employer taxpayers who earn money.

This video tutorial gives you an overview of. Check Your Refund with MassTaxConnect.

Finance Acquisition Value Chain Model

Tax Guide For Pass Through Entities Mass Gov

Masstaxconnect Resources Mass Gov

Massachusetts Sales Tax Small Business Guide Truic

Masstaxconnect Resources Mass Gov

Massachusetts Sales Tax Guide And Calculator 2022 Taxjar

Advantages And Disadvantages Of Accounting Merits And Demerits Of Accounting Business A Plus Topper Business Valuation Accounting Advantage

French Connection Aimee Abstract Print Tiered Midi Skirt Brown Patina Cream Tiered Midi Skirt Midi Skirt Sophisticated Shirt

Mobile Concept Tax Prep For The Modern Worker Tax Prep Tax App Mobile App Design

Opt In And Contribute To Paid Family And Medical Leave As A Self Employed Individual Mass Gov

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Beautiful Invoice Templates For Uk Sole Traders Ltds And More Invoice Design Invoice Template Word Invoice Template

Ppt Cost Benefit Analysis Powerpoint Presentation Free Pertaining To Cost Effectiveness Analysis Powerpoint Presentation Analysis Project Management Templates

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov